Kenya’s public debt has reached Ksh11.81 trillion, representing 67.8 per cent of the country’s Gross Domestic Product (GDP), according to the latest update from the Treasury, even as it emerged that the government has been spending an average of Ksh4.17 billion on repayments.

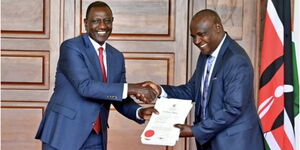

According to the Treasury CS John Mbadi, during the 2024/2025 fiscal year, the government effected Ksh1.72 trillion in debt service payments, comprising Ksh1.14 trillion to domestic lenders and Ksh579 billion to external creditors.

During the same financial year, the government spent Ksh1.72 trillion on debt servicing alone, a figure that continues to put pressure on the national budget.

Mbadi revealed that, in present value terms, the debt stands at 63.7 per cent of GDP, a level assessed as sustainable but accompanied by a heightened risk of distress.

He stated that the debt stock comprises Ksh6.33 trillion in domestic obligations and Ksh5.48 trillion in external debt owed to lenders such as the World Bank, African Development Bank (AfDB), China, and Eurobond holders.

What Govt is Doing

CS Mbadi noted that to mitigate prevailing debt vulnerabilities, the Treasury has embarked on a number of liability management operations, including refinancing of high-cost obligations.

Additionally, the government is also keen on the extension of debt maturities and increased uptake of concessional financing to improve debt sustainability metrics.

Further, he noted that prudent debt management would remain central to Treasury’s fiscal policy, with efforts focused on safeguarding critical government services and restoring investor confidence.

''Under the 2025 Medium-Term Debt Management Strategy, the Treasury aims to lengthen the maturity profile of Kenya’s debt, reduce exposure to interest and exchange rate shocks, and promote intergenerational equity,'' the Treasury said.

Adding that: ''The strategy projects that 75 per cent of borrowing will be sourced domestically, while 25 percent will come from external concessional loans.''

Meanwhile, Mbadi outlined that Kenya’s debt-to-GDP ratio is projected to decline gradually over the medium term, driven by fiscal discipline, structural reforms, and stronger revenue collection.

He said these measures are critical to stabilising the economy and maintaining investor confidence at a time when there are rising global interest rates.

Panic as 33-Seater Bus Plunges Into River Breaking News