The Nairobi County government has intensified efforts to crack down on property owners who have or intend to default on land rates, putting landlords on high alert.

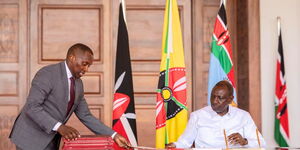

As recently as Saturday, May 24, Governor Johnson Sakaja directed landowners in five sub-counties: Kasarani, Embakasi East, Embakasi West, Embakasi Central and Embakasi North, to register their lands in the county database.

But what exactly are land rates, and who is the county targeting? Here is a breakdown of everything you need to know, especially if you intend to become a landlord in future.

Land rates are a type of property tax levied annually by county governments on landowners, particularly in urban and developed areas. In Nairobi, land rates typically apply to leasehold property, as in property that has been leased from the government for a period ranging from 33 to 99 years.

While it is often confused with land rent, which is paid to the national government, land rate collection is the responsibility of the county government and is calculated based on the unimproved site value (USV) of the land. USV basically means the value of the land without any developments on it.

Land rates are a crucial levy for the county government since they help generate much-needed revenue to fund essential services, which Nairobians often complain about, like garbage collection, water and sanitation and urban planning.

In an urban jungle like Nairobi, where public resources are consistently stretched, resources are paramount, hence the recent intensity in cracking down on land rate defaulters.

So are all buildings in Nairobi supposed to pay land rates? The short answer is no. Only properties on leased public land are usually affected by the levy. So if you own land under a freehold title, you may be exempt from land rates.

With this in mind, the recent enforcement campaign by Nairobi county has seen landlords, commercial property owners and, in some cases, residential buildings (like those in the Kariokor estate) get targeted for allegedly failing to pay land rates for years. In such cases, the property owners face hefty penalties, interest on arrears and in extreme cases, threats of auction for failure to settle outstanding balances.

Penalties can, however, be avoided if property owners on leased land do their due diligence. The first step is to confirm the ownership status of the land by checking your title deed. If the property is leasehold, you are legally required to pay land rates.

The county government typically expects payment of land rates by the end of March every year. To make payments, one needs to register on the Nairobi County e-Services portal to access property information and check balances. All payments can be made online through the platform.

If it is, you are legally required to pay land rates. Secondly, you should register on the Nairobi County e-Services portal, where you can access property information, check balances, and make payments online. This platform has made it easier for property owners to stay updated and manage their obligations from anywhere.

Land rates are due annually, and the county government usually expects payment by the end of March each year. Early payment is encouraged to avoid penalties and to take advantage of any discounts that may be offered for prompt settlement.

Another crucial step for property owners is to request a rates clearance certificate after payment. This document is extremely important, as it will serve as proof that your rates are fully paid and up to date in situations such as transferring property ownership, applying for development approvals, or resolving disputes with the county.

Lastly, it is fundamental to keep proper records, including receipts of payment, as this can come in handy in the event of system errors. It also ensures one's property remains in good legal standing.

In the latest notice by the Nairobi County government on registration for land rates, the process began on May 19, and enrolment would take place for the next 12 days, with the deadline set for May 30.