Kenya has signed the Double Taxation Avoidance Agreements (DTAAs) with the Czech Republic that will see the elimination of double taxation.

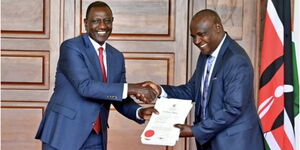

In a statement on Tuesday, September 23, the Treasury confirmed that the agreement was signed by Treasury Cabinet Secretary John Mbadi and the Czech Republic's Ambassador to Kenya, Nicol Adamcová.

Double taxation means that the income or profit of a company is taxed twice. For instance, before the agreement, if a Kenyan company had a branch in the Czech Republic, the owner of the business paid tax to both Kenya and the Czech Republic.

However, after the agreement, only one country has the right to tax a company. If a Kenyan company operates in the Czech Republic without a permanent office, Kenya alone has the right to tax the profits of the company, but if the company has a permanent office, the Czech Republic will tax the profits.

"CS Hon. John Mbadi and Her Excellency Ms Nicol Adamcová, Ambassador Extraordinary and Plenipotentiary held a signing ceremony of the agreement for the elimination of double taxation between the Republic of Kenya and the Czech Republic at the Treasury building," Treasury stated.

"The ceremony was witnessed by a delegation from the Czech Republic, officials from the National Treasury, Ministry of Foreign and Diaspora Affairs, Kenya Revenue Authority, and Office of the Attorney General," it added.

Mbadi noted that the agreement will be fundamental in curbing tax avoidance and evasion, which is often a result of poor tax planning.

Furthermore, the CS assured that the pact will be key in reinforcing the healthy diplomatic ties the two countries have shared over the years, in addition to empowering businesses in the two countries.

"Mbadi noted that the agreement reflects the enduring strength of Kenya–Czech relations and constitutes an important milestone for the business community by offering clarity and predictability in the taxation of cross-border income," Treasury stated.

" He further stressed that the pact will curb tax avoidance and evasion arising from improper tax planning while creating deeper collaboration between the two countries’ tax administrations," it added.

So far, Kenya has signed DTAA agreements with 15countries, which include Canada, Denmark, France, Germany, India, Iran, South Korea, Norway, Qatar, Seychelles, South Africa, Sweden, the United Arab Emirates, the United Kingdom, and Zambia.

"Double taxation is often an unintended consequence of tax legislation. It is generally seen as a negative element of a tax system, and tax authorities attempt to avoid it whenever possible," National Treasury states.