The Ministry of Transport has proposed to increase the Fuel Levy Charge from the current Ksh18 to Ksh25 per litre, in the current Finance Bill 2024.

The new proposal could see fuel prices increase by Ksh7 per litre.

This move aims to raise much-needed funds for road maintenance, but the repercussions could ripple through the economy, causing a hike in commodity prices and electricity costs.

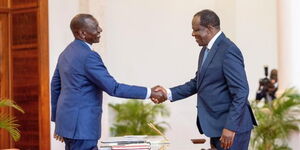

Transport Cabinet Secretary Kipchumba Murkomen, addressing the Finance and National Planning Committee of the National Assembly on Tuesday, June 11, emphasised that the current fuel levy rates, unchanged since July 2016, no longer reflect the escalating costs of road construction and maintenance due to inflation.

The proposed adjustment is part of the Finance Bill, 2024, and Murkomen underscored the urgency, stating that the current rates have eroded the levy’s purchasing power over time.

The tax, known as the Road Maintenance Levy Fund (RMLF), is applied at the fuel pump, where it stands at Ksh18 per litre of petrol and diesel, with Ksh3 allocated to an annuity fund and the remainder directed towards road maintenance, rehabilitation, and development.

Murkomen noted that increasing the fuel levy to Ksh25 per litre could halt the rising maintenance backlog and generate up to Ksh115 billion annually for road improvements, compared to the current Ksh83 billion.

"When the fuel levy was last set at Ksh18 per litre in 2016, the pump price of petrol in Nairobi was Ksh95. As of May 2024, the price has soared to Ksh194, while the levy remains unchanged. This stark contrast illustrates the diminishing value of the fuel levy due to inflation," Murkomen explained.

He also stated that the additional revenue from the levy increase would be instrumental in bridging the Ksh315 billion road maintenance financing gap projected over the next five years.

Fuel in Kenya is subject to nine different taxes, including a 16 per cent VAT, anti-adulteration levy, excise duty, petroleum development levy, railway development levy, and import declaration fee.

This complex tax structure has long been a point of contention, with critics arguing that the cumulative burden on consumers is excessive.

Adding to the complexity, the Energy and Petroleum Regulatory Authority recently reduced fuel prices by up to Ksh18 in their latest review. Currently, super petrol in Nairobi retails at Ksh193.84, diesel at Ksh180.38, and kerosene at Ksh170.06.

Adding the Ksh7 price increase, Kenyans could pay Ksh200 for Super Petrol in Nairobi.