The Kenya Bankers Association (KBA) on Thursday opposed two bills that are currently before the National Assembly. the first seeks to regulate the employment and leadership of banking professionals within the country and the second bill seeks to regulate the banking sector.

The two bills, the Bankers Professionals Bill, 2024, and the Credit Professionals Bill, 2023, are also aimed at imposing regulation of the banking sector. If passed, the MPs noted that the bills will eliminate fraud and bring in professionalism within the banking sector as part of broader reforms to address financial fraud in the country.

The Bankers Professionals Bill proposes a fine not exceeding Ksh10 million or imprisonment for any one found engaging in banking activities without authorisation, that is including holding a license.

The Credit Professionals Bill, 2023, seeks the establishment of powers and functions of the Institute of Certified Credit Professionals of Kenya to provide for the examination and the registration of certified credit professionals and for the regulation and development of the credit profession and for connected purposes.

"A person who engages in practice as a credit practitioner without a valid license issued by the board commits an offense and shall be liable on conviction to a fine not exceeding Ksh10 million or to imprisonment for a term not exceeding 7 years, or both,"

The bill also aims to deal with bank executives who take part in fraudulent financial activities and promote integrity within the banking sector.

The bill also seeks to regulate the development of the credit profession among other functions.

KBA Acting Chief Executive Officer Raymond Molenje told the MPs that the proposed legislation will hinder economic growth and limit employment opportunities within the banking sector.

The bankers told the lawmakers that the proposals would present such because of the stringent regulatory framework that would see only professionals work in the banking sector.

Molenje specifically pointed to the fact that the sector has employees cutting across different professions.

“The banking sector focuses on employing more on competencies and skills rather than specific academic qualifications. It is impossible to govern a sector that comprises over 40 different professions working within the banking sector. Banking professionals range from executives, lawyers, audit, procurement, surveyors, medical, hospitality, human resources, and many other professions in all types of businesses.” Molanje argued.

The association also told the MPs to do a comparative analysis with other countries, noting that such provisions are not in other countries.

The professionals told the MPs that they harbor suspicions about a plot by the state to remotely control the sector through self-centered interests.

“We welcome professional regulation within the sector, however, I am afraid that these bills are centered on self-interest and intentions of having control over banking operations,” he added.

The lawmakers, however, raised concerns about the issues raised by the bankers, casting a blanket of doubt over their submissions.

“Why is the CEO so vehemently opposing the formulation of government-backed regulation, yet the Kenya Bankers Association in itself is a body set up to oversee the operation of banking professionals?” enquired the Committee's Vice Chair and Turbo MP Janet Sitienei.

The KBA heads informed Parliament that they were opposed to the two regulations on the basis that they stood to have a negative impact on the banking sector by undermining their operations.

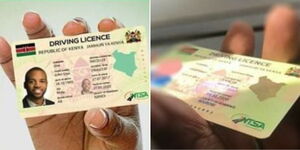

Cabinet Okays New Driving Licences News Just In