The National Social Security Fund has announced its 8th Annual General Meeting, scheduled to take place virtually on February 6, 2026, at a time when there is rising scrutiny over the government’s proposed use of NSSF funds for infrastructure development.

The meeting, according to the notice to members, will be conducted online and is open to all NSSF members, with attendees required to register online in advance.

The AGM agenda includes presentations of the Managing Trustee’s report, the Board of Trustees’ report, the actuarial report, the audited financial statements for the year ended June 30, 2025, and fund management and custodial reports.

According to the notice published on Wednesday in the local dailies, the meeting will offer an opportunity for members to engage directly with the fund’s management and seek clarifications on how their savings are being managed and other important matters.

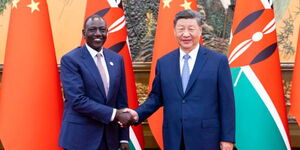

The AGM comes at a time when President William Ruto has sparked debate by announcing that the government intends to stop external borrowing to finance development projects within 10 to 20 years, in an attempt to address the country's growing foreign debt deficit by using the NSSF savings, prompting questions about the safety and oversight of the pension fund.

Speaking at a breakfast meeting with administrative officers at State House in Nairobi during the launch of the Jukwaa la Usalama Report on December 2 last year, Ruto said that the government would rely more on the securitisation of Kenyans' savings in the NSSF to fulfil its financial and development obligations.

“The money we have collected in the last 60 years with NSSF amounts to Ksh320 billion by December 2022. Since we embarked on the new model, by the end of this month, our savings will be at Ksh670 billion. By June 2027, we will have Ksh1 trillion,” Ruto said.

He added that Kenya’s current reliance on external loans, particularly from China, could be replaced in the future by locally generated savings.

However, critics have expressed concern that using pension savings for public infrastructure could expose the fund to financial risks, while proponents argue that it could accelerate the delivery of key development projects without additional borrowing.

In Kenya, contributions to the NSSF are shared between employees and employers. For most workers, both the employee and employer contribute roughly the same amount each month, with combined totals ranging from about Ksh960 for lower-income earners to Ksh8,640 for higher earners.

The exact amount depends on monthly earnings, but generally, each party contributes between Ksh480 and Ksh4,320 per month.

For 2025, the contribution rules were revised such that both employee and employer contribute 6 per cent of pensionable earnings. This means contributions are capped, with the maximum monthly payment by either party at Ksh4,320.