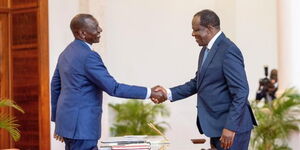

Treasury Cabinet Secretary Njuguna Ndung’u on Friday, February 23, dismissed allegations levelled by the Controller of Budget Margaret Nyakang’o, alleging the government took expensive loans from the International Monetary Fund (IMF) and World Bank.

Ndung'u while responding to Nyakang'o, clarified that the loans taken from the two global financiers attracted interest rates of between 0 to 6.74 per cent, contrary to the Controller of Budget's 14.5 per cent.

The CS termed Nyakang'o's statement as misleading and risk-straining Kenya's relationships with valuable development partners and even foreign investors.

“The Controller's assertions, suggesting exorbitant interest rates of 14.5 per cent, are not only sensational but also inaccurate,” read part of a statement by the treasury CS.

Ndung'u noted Kenya’s debt with the IMF stood at USD2.68 billion, attracting interest rates ranging from 0 to 6.07 per cent per year.

Similarly, the CS noted the nation's debt owed to the World Bank under the concessional International Development Association (IDA) window totals USD11.3 billion, with interest rates varying between 0.35 and 1.39 per cent per year.

"Additionally, debts under the non-concessional IBRD window stand at USD1 billion, with interest rates ranging from 2.19 to 6.74 per cent per annum," Treasury stated.

On February 22, the Controller of the Budget flagged the cost of loans taken by the government, calling for an audit on funding received from the multilateral lenders, IMF and World Bank.

In the National Government Budget Implementation Review Report covering the first six months of the current financial year, the CoB alleged that the debt surpassed the set limit of 55 per cent of the GDP.

While raising the concerns, Nyakang'o advised the Executive to undertake various fiscal measures to ensure the debt portfolio is reduced amidst the fluctuating exchange rate.

"Notably, the public debt stock surpassed the parliamentary limits. The Controller of Budget recommends that there is a need to reduce deficit budget financing through fiscal consolidation to curb further growth of public debt," read part of a statement by the National Government Budget Implementation Review Report.

"Further growth in public debt strains revenue since public debt is a first charge to the Consolidated Fund," the report added.

Nyakang'o in her statement noted Kenya's outstanding debt stood at Ksh11.14 trillion as of December 31 last year. The debt comprised Ksh6.09 trillion owed to external lenders and Ksh5.5 trillion from domestic lenders.