It has emerged that the International Monetary Fund (IMF) cautioned the Central Bank of Kenya (CBK) early last year, concerning dangerous lending habits that Kenyan banks were practising.

Interestingly, current CBK Governor, Dr Patrick Njoroge, was serving as an Advisor to the Deputy Managing Director of the IMF when the warning was issued.

The IMF noted that as Kenyan Banks were experiencing an exponential growth in profits and lending, they were not setting aside enough reserves to cushion them against defaults.

“The banking sector remains profitable and well-capitalised but provisions are lately lagging behind a pickup in Non Performing Loans, which moderated slightly in September (5.5 percent of total loans).” said the IMF in a report compiled early last year.

A Non Performing Loan is the sum of money borrowed upon which the debtor has not made his or her scheduled payment for a period of at least 90 days. It is either in default or close to being in default.

The IMF had stated that a laxity in the supervision of banks and the warning, should have served as a wake up call to the Central Bank of Kenya, which was at the time headed by Professor. Njuguna Ndung'u.

If the warning was heeded, it could have probably saved Kenyans the anguish they have been forced to endure, following the decisions to put Chase Bank, Dubai and Imperial banks under receivership.

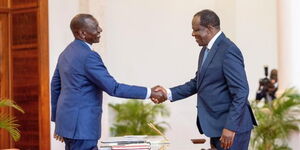

Dr Njoroge assumed office in June 2015 and immediately issued a directive to banks, asking them to review and reclassify their loan portfolios. The directive apparently, disrupted growth in profits in the banking sector.

The CBK Governor said that the trend in the sector where only profits mattered had to end as he aimed at creating a resilient banking industry.