President William Ruto’s administration will not receive the entire Ksh193 billion ($1.5 billion) loan facility from the United Arab Emirates (UAE) in a single disbursement.

According to Bloomberg, the government now plans to stagger the disbursement in tranches to remain within the borrowing limits set by the International Monetary Fund (IMF).

Following the paradigm shift, Kenya will now receive the first tranche of disbursement worth Ksh90 billion in January next year with the rest of the amount set to be channelled to the Kenyan accounts later.

Treasury Principal Secretary Chris Kiptoo who spoke to the American publication revealed that Kenya will consider the dates for the disbursements based on the availability of the money by the UAE government.

In a recent presser, Treasury Cabinet Secretary John Mbadi disclosed that the Bretton Woods Institution expressed reservations over the government’s decision to acquire the multi-billion loan from the Asian nation.

IMF, according to Mbadi, noted that the loan could expose Kenya to foreign exchange risks and that the amount sought by Kenya from UAE was beyond the Ksh168 billion ($1.3 billion) commercial-borrowing ceiling.

Similarly, IMF Spokesperson Julie Kozak in a press briefing on Thursday, November 21 said that “Treasury authorities in Kenya must consider the loan’s impact on its fiscal and debt targets.”

In September this year, Kenya commenced talks with the UAE for the acquisition of Ksh193 billion to narrow the budget deficit following President Ruto’s decision to scrap the defunct Finance Bill 2024 in June.

The loan which would be disbursed with an interest of 8.2 per cent was requested by the government following the delays in the release of the IMF loan.

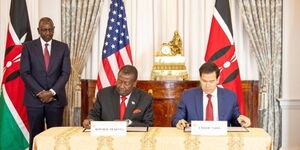

To avert debt distress, the government signed up IMF's Ksh464 billion loan facility programme in 2021. In the agreement signed four years ago, the multilateral lender would have the ability to limit Kenya's borrowing ability.

In the deal with IMF, Kenya would also be required to meet the lender's regulations to acquire the Ksh464 billion loan that would be disbursed in phases.

The first phase of the loan worth Ksh78 billion was disbursed on October 30 this year following the completion of the seventh and eighth reviews. According to IMF, the decision to disburse the loan was due to Kenya's adherence to the set conditions such as stabilising the local currency and reducing inflation.