Kenyans are set to be relieved from purchasing commodities at hiked prices necessitated by inflation and other factors such as the Russian invasion of Ukraine.

World Bank, in its October 2022 report titled Commodity Markets Outlook, highlighted that the prices of basic commodities and other services will decline in 2023.

Despite the decline, some of the key products may still experience increased demand next year. With low supply, the 2022 prices may be maintained.

Fuel

According to a World Bank report, fuel prices retreated from their peaks in the aftermath of the post-pandemic demand surge, and the war in Ukraine diverted its costs.

However, divergent trends and differences in supply conditions will compel fuel prices to drop slightly in 2023. With also currencies stabilising around the globe, fuel prices are set to stabilise further in 2024.

"After surging by an expected 60 per cent in 2022, energy prices are projected to decline 11 per cent in 2023, and a further 12 per cent in 2024," the World Bank report read in part.

"Key drivers of the outlook include slower global growth, weaker demand for natural gas as households and industry reduce consumption," it added.

Currently, a litre of petrol retails at Ksh178, Diesel at Ksh163, and Kerosene at Ksh146.

Transport and Electricity

World Bank projected the cost of transport and electricity to decline in 2023. They attributed the cost retreat to a drop in fuel prices and currency stabilisation.

"The outlook is subject to numerous risks, especially on the supply side.

"First, production in the United States could disappoint as producers prioritize returning cash to shareholders over increasing output, and higher input costs constrain new investment," it, however, warned.

For the last two months, the price of tokens increased following reviews done by the Energy Petroleum and Regulatory Authority (EPRA).

Agricultural Prices

It projected agricultural prices to decline by 5 per cent in 2023 before stabilising in 2024.

The projected decline in 2023 reflects a better-than-expected global wheat crop, stable supplies in the rice market, and the resumption of grain exports from Ukraine.

"Disruptions in exports from Ukraine or Russia, both key grain exporters, could once again interrupt global supplies, as they did in the early stages of the war in Ukraine," World Bank projected.

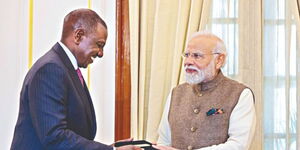

The report aligns with President William Ruto's promise to lower Unga prices in one year's time.

Gas and Coal

Natural gas and coal prices are also expected to ease in 2023 and 2024 but remain at much higher levels than their pre-pandemic averages.

The expected easing of prices next year is due to weaker demand for natural gas as households and industries curtail their consumption and switch to substitutes.

Also, coal production is expected to increase as China, India, and seaborne exporters boost output.

The shifts are expected to affect the prices of gas in the country, which increased drastically from April 2022.

Food Market

The report projected an increase in demand in the food market. World Bank attributed the increased demand to the war in Ukraine and other natural calamities causing severe food insecurity.

"Materialisation of the upside risks to food prices outlined could result in even larger increases in the number of people suffering from food insecurity," the report indicated.

Property Index

According to the report, metals used in the property industry are projected to decrease in price. However, with the surge in demand, the metal refiners are set to increase production costs, thus affecting the overall cost.

"One upside risk is higher-than-expected energy prices which could lead to increased production costs for metal refiners.

"In the longer term, however, metal demand is expected to increase, stimulated by recent government policies to accelerate the energy transition and boost renewables, which are metals intensive," World Bank projected.