The Kenyan Government is set to incur a small expense following the sensational withdrawal of the deal with Indian conglomerate, Adani Holdings, as the search for a new private partner begins.

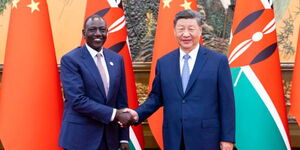

In the wake of President William Ruto’s bombshell announcement on Thursday that the government would walk away from any deals with Adani, questions were raised on the financial implications of the termination of the deal with KETRACO, which was in its advanced stages.

Treasury Cabinet Secretary John Mbadi sought to clarify particulars of the deal after President Ruto’s State-of-the-Nation address insisting that the country could not incur any losses thanks to a Privately Initiated Partnership procurement arrangement in place. Mbadi further stated that since only a deposit was made to the Indian conglomerates, that payment would be refunded.

However, owing to the complex nature of a deal involving a state and a private partner, the government faces a tedious three-step process to terminate the deal, which will also entail paying for verifiable costs.

At the moment, the only major verifiable cost entails payment for the assessment reports, which is quite minimal, with all factors considered.

"What we had agreed is that any cost that is verifiable, in terms of the Environmental Assessment Reports, and we know the cost of doing this, can be reimbursed back to Adani. The Law also gives a maximum cap and vis-a-vis in terms of arguing for not paying," John Mativo, Managing Director of KETRACO, said.

In Kenya, the cost of an environmental assessment report (EIA) will vary depending on the project and the expert involved.

Assessment costs are typically 0.1% of the total cost of the project to a minimum of Ksh10,000 with no upper capping. Since the KETRACO-Adani Energy deal had a stated cost of Ksh96 billion for 372km of transmission lines, an EIA of up to Ksh96 million could be incurred.

However, this is all subject to the interpretation of what was in the clauses in the deal between the government and Adani.

What next? KETRACO is now set to write to Adani a comprehensive report detailing the reasons for pulling out of the deal. Adani could seek recourse in demanding payment for the costs of the assessments it performed before the start of the project.

However, the Indian company could also write back to confirm mutually pulling out of the deal with KETRACO.

Further, the government has grounds to avoid overlooking the EIA costs since it could argue that Adani failed to provide sufficient documents for due diligence before agreeing on a deal.

On Wednesday, Adani Group founder Gautam Adani and seven others were accused by US authorities of paying Ksh34 billion in bribes to Indian officials. - allegations that the group denies.