World Bank, on Tuesday, May 30, announced that it had approved a Ksh138.5 billion loan to help Kenya ease its debt burden and strengthen a weakening currency.

In a statement, World Bank’s senior economist, Aghassi Mkrtchyan, stated that the funds would be awarded through a Development Policy Operations (DPO) instrument.

He noted that the instrument would commit Kenya to implement changes to enhance fiscal flexibility, competitiveness in agriculture, and governance.

"The DPO's support for the government's reforms will help to achieve fiscal consolidation, which is essential for reducing the debt burden and related risks in an equitable and sustainable manner," the Economist stated.

In the agreement, Kenya will eliminate administrative price-setting for publicly procured cereals and streamline an exit from commercial investments.

Kenya qualified for DPO financing in 2019 and received four such loans, the most recent in March 2023.

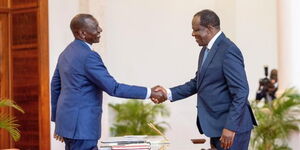

Earlier on Monday, May 29, President William Ruto raised concerns about the increasing dollar crisis in Kenya and worldwide, stating that it had strained business activities.

The Kenyan shilling hit a new record low of 138.50 against the dollar, with Kenya facing more expensive imports and debt servicing distress.

During the African Private Sector Dialogue on African Continental Free Trade Area (AfCFTA) and the 3rd Kenya International Investment Conference, Ruto proposed the formation of an African export and import bank as a payment authority within the continent.

According to the Head of State, the move would eliminate the obstacles caused by the difference in currencies and allow investors to pay in local currencies instantly.

"We are all struggling, and our businessmen are struggling to make payment for goods and services from one country to another because we are subjected to a dollar environment.

“Why are we bringing dollars in the middle of our trade? Our business people are stranded because we are looking for dollars,” lamented Ruto, at Safari Park Hotel, Nairobi, on May 29, 2023.

Further, he noted that the African Export-Import Bank had already embarked on building a centralised payment system across Africa known as the Pan African Payment and Settlement system.

"One of the challenges African countries face is the delay during transactions, as it takes about three to five days for the payment to get to the recipient’s bank, with multiple charges throughout the process," he noted.

Most African local banks and businesses use US and European correspondent banks to complete payments between two African currencies. The dollar and the Euro are among the top trading currencies during the foreign exchange.