The University of Nairobi is facing scrutiny over Ksh7.4 million in unpaid rent to the Kenya Medical Training College (KMTC), a debt that has lingered for seven years.

The issue came to light during a meeting between KMTC leadership and the Public Investments Committee on Social Services, Administration, and Agriculture (PIC-SSAA) on Monday, where the college highlighted how outstanding debts, including UoN’s arrears, have strained its operations.

Documents presented to the committee revealed that UoN rented 96 rooms owned by KMTC for its medical students but failed to make payments. Despite being served with an eviction notice in July 2018, the university has neither vacated the premises nor addressed the outstanding rent.

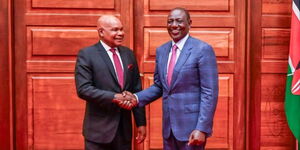

KMTC CEO Dr Kelly Oluoch told lawmakers, led by Saboti MP Caleb Amisi, that the college had escalated the matter to the Attorney-General and the Head of Public Service, providing legal documents showing that the property belongs to KMTC.

The revelations have raised fresh questions about UoN’s financial management and accountability, coming at a time when the university is already engulfed in a leadership dispute pitting the council against the Ministry of Education over who should lawfully occupy the Vice Chancellor’s office.

The conflict began after former VC Stephen Kiama was removed from office in late 2024, prompting the council to appoint Margaret Jesang Hutchinson as Acting Vice Chancellor, a decision the ministry later endorsed as the only valid appointment.

Tensions escalated in May 2025 when the university council attempted to bring in Bitange Ndemo as substantive VC, a move that was swiftly challenged over alleged procedural breaches. Ndemo eventually withdrew his candidacy, citing irregularities, while the ministry publicly disowned the council’s process, insisting that Hutchinson remained the legitimate office holder.

Meanwhile, during the parliamentary session, KMTC also sought Treasury guidance on writing off long-outstanding debts, including Ksh21.8 million from Kenyatta National Hospital and Ksh19.8 million from the former Ministry of Medical Services, both of which were recommended for write-off but lacked ministry approval.

Also, the lawmakers raised an alarm, disclosing that there was a Ksh2.125 billion pension deficit within the college’s defined benefit scheme as of June 2024.

The CEO, however, explained that actuarial valuations revealed that scheme assets had not grown sufficiently to meet obligations for current and future retirees.

“While pension benefits for current retirees are protected by law, we’ve had to finance remedial measures from student fees,” he said, warning that relying on student revenue could trigger long-term liquidity challenges without Treasury intervention.

In response, the committee resolved to invite the Retirement Benefits Authority (RBA) and the Treasury teams to examine systemic issues affecting public institutions’ pension schemes.