Kenya and the International Monetary Fund (IMF) have agreed on the disbursement of a Ksh 262.7 loan facility subject to certain conditions.

The loan from IMF will be disbursed through the Rapid Credit Facility (RCF) and the Extended Fund Facility (EFF) which Kenya intends to use as a response to the effect of COVID-19.

The primary agreement by the staff levels is that the loan should be distributed over the next 38 months.

Mary Goodman, a team member from the IMF said that the loan facility will be laying the foundation for Kenya to begin stabilizing its economy and reduce the debt levels.

“The program will support the next phase of the country’s COVID-19 response and the authorities’ plans for a strong multi-year effort to stabilize and begin reducing debt levels relative to GDP, laying the ground for durable and inclusive growth over the years to come,” Goodman said during their tour of the country.

However, the staff-level agreement awaits approval from the IMF management and Executive Board.

The team submitted their report to Treasury Cabinet Secretary Ukur Yatani, Central Bank of Kenya (CBK) Governor Patrick Njoroge, Head of Public Service Joseph Kinyua among other government officials.

The report that led to the team’s conclusion was conducted in Kenya toward the end of 2020 and was concluded on February 15.

Kenya is also expecting other multilateral lenders like the World Bank Development Policy Operations (DPO) to disburse Ksh 82.5 billion and Ksh13.8 billion from the African Development Bank (AfDB).

The IMF’s report on the program aims at reducing Kenya’s debt vulnerabilities which are also centered on raising tax revenues and tight control of spending.

The Ksh 262.7 billion is also expected to safeguard Kenya’s resources thus protecting vulnerable and marginalized groups.

The government is also expected to make a comeback in the commercial market by seeking Eurobond funding totaling Ksh 124 billion.

The 2021 Budget Policy Statement (BPS) indicates that the cheaper loans that the government was targeting have been exhausted hence the need for external commercial funding.

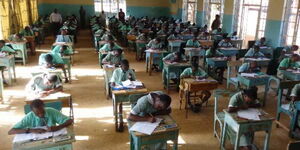

KNEC Releases 2025 KJSEA Results, How to Check Breaking News